Thoughts from the Desk of Bob Repass…

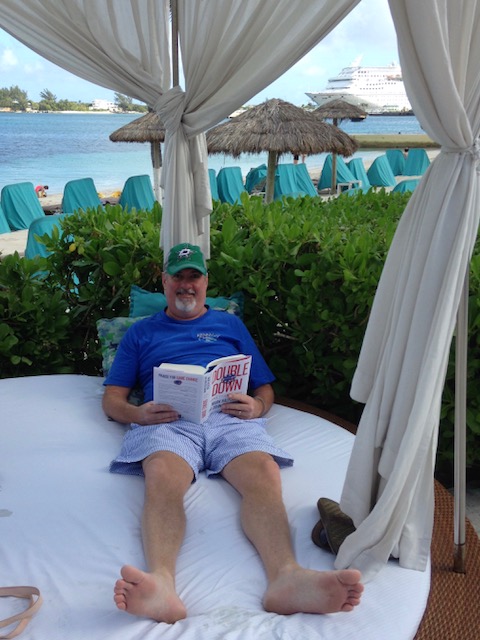

Say hello to summer! One of the traditions that takes place this time of year is a number of people, such as Bill Gates, come out with lists of books they think are worth reading this summer. So why not, Bob’s Summer Reading List? Whether you are relaxing on the beach, flying on an airplane, sitting in your backyard, or just going about your normal routine, here are 5 books worth reading this summer. Some I have already read and some are on my list to read this summer.

#5 Bobby Kennedy: A Raging Spirit by Chris Matthews: I am currently halfway through this book which is an impressive portrayal of the life events that made Bobby Kennedy the man and leader he was.

#4 Crushing It! How Great Entrepreneurs Build Their Business and Influence and How You Can, Too by Gary Vaynerchuk: I can’t wait to get started on this book by one of today’s top entrepreneurs and successful podcasters and learn and share the ideas and inspiration I have heard about in it.

#3 The Murders in the Rue Morgue by Edgar Allan Poe: I don’t usually download many books to my tablet, but I recently downloaded a collection of Poe’s writings to read on my upcoming travels. This short story, recognized as the first modern detective story, is the first I will reread.

#2 The President is Missing by Bill Clinton and James Patterson: This book just came out and features the writing combination of the former President and one of the most prolific authors of today. This will surely be a bestseller and I am curious to see if it lives up to all the hype!

#1 Principles: Life and Work by Ray Dalio: This one has been on my reading list since it came out last fall. Dalio is the founder of Bridgewater Associates which over the last 40 years has become one of the largest and best performing hedge funds in the world. I figure if Tony Robbins says “I found it to be extraordinary. Every page is full of so many principles of distinction and insights – and I love how Ray incorporates his history and his life in such an elegant way.” Then this is a book I must read.

Let me end with another quote from Tony Robbins, “I always believe leaders are readers, so you’ve got to read 30 minutes a day of something that’s going to inspire you.” I challenge all of you to read at least 30 minutes a day and be the leader you desire to be.

Stay up to Speed with Eddie

It’s Time To Change What You Brag About

by Eddie Speed

People love to brag. Bass fisherman brag about the big “lunker” they landed. Deer hunters brag about how many points on their trophy buck’s antlers. Antique collectors brag about the rare piece they found in a garage sale. And real estate investors love to brag about how much they shaved off the asking price when they bought a property – at least they used to brag about that, until times changed.

Big fish are still out there waiting to bite your lure, trophy bucks are still running around the woods, and rare antiques still pop up in garage sales. But in today’s real estate markets, those brag-worthy discount prices on properties have all but gone extinct.

As any savvy investor can tell, the winds of business have changed and now they’re blowing directly toward seller financing – especially when you’re the buyer. Getting the seller to finance the property you’re buying allows you to make money in ways you didn’t know were possible.

GIVE YOURSELF SOMETHING NEW (AND BETTER) TO BRAG ABOUT

Here’s why the time is right for seller financing. Getting a seller to knock a big chunk off their asking price is a thing of the past, which is another reason bragging rights are harder to come by. Because of today’s red hot seller’s market, real estate investors are having to make offers on twenty different properties before one offer gets accepted.

Newbies in the business think they’re going to put a handwritten bandit sign on a street corner and expect to get flooded with calls from people wanting to sell their property cheap. I tell them, “Don’t hold your breath.”

Closing only one out of twenty offers gives you a 5% buy conversion rate. And when you’re spending big bucks on marketing to locate sellers, a 5% success rate is not going to impress your friends around the country club.

Times have changed (as they always do), which means it’s time to change the way you do business. And when you change the way you do business, you’ll change what you brag about.

Investors used to brag: “I bought a house at 20% off the asking price.” But you don’t hear people saying that nowadays. Today, smart investors have a whole new thing to brag about, and it’s actually even more impressive: “The monthly payment on the house I bought is only half of what it will rent for.” Mention that at the golf course right when your buddy is hitting a putt, and his ball will end up in the next county.

While you’re bragging, you can lay it on thick by adding that you paid nothing down. And you doubled your buy conversion rate without doubling your marketing costs.

How can you do this? By offering the seller 100% of their asking price – which would have been crazy a few years ago, but not today.

DON’T LET SOME BANK SET YOUR TERMS… LEARN TO SET THEM YOURSELF!

On a typical deal for an investment property you buy, you take a beating from the seller who wants too much money. You clench your teeth to make an offer that finally gets accepted, then you talk to your bank or funding source to get the financing, where you get beat up again! Without question, they’re going to set the terms that are weighed heavily in their favor. (And to be honest, if you were a banker you’d do the same thing.)

You need to unlearn the notion that seller financing is only for when you’re the seller. Offering the full asking price AND knowing how to structure a deal with seller financing when you’re the buyer is what puts you in the catbird seat. And that’s a really nice place to be sitting!

Buying on terms gets the seller to carry the financing for you, which solves a gigantic industry problem. Plus, it gives you a huge edge over your competition if you can offer the full asking price while they’re still nickel and diming the seller.

The beauty of knowing how to architect a deal with seller financing is that you can set those terms so they’re in your favor. Sure, the terms have to be acceptable to the seller, but when you’re giving the seller the full asking price then they feel like they’ve already won. You’ll be surprised how flexible they can be on the terms. Here at Colonial Funding Group, we price seller financed notes all day, every day – so we know what’s happening in the real world. And we see deals all the time that were financed by the seller for 0%!

So what if you have to pay 20% more than everybody else? You’ll make it up on the back end. Or you could divide the note into first and second partials and sell the first to cover your down payment. Or you could do a subordination agreement. Or you could offer an exchange of collateral in the security documents. Or you could use tons of other creative financing techniques – if you know how to do it.

When you understand the full potential of creative seller financing, it sets you free from doing deals the same way every other investor does them. You don’t have to follow the trend – you can set the trend.

THE TIME IS RIGHT FOR SELLER FINANCING

Seller financing isn’t new, but it’s new to most investors.

I first started doing seller financing back in 1980. Where were you in 1980? Four years old?

Back then, the interest rate on conventional mortgages was around 18%. The time was right to do something unconventional. There were tons of buyers who couldn’t afford the sky-high interest rates, but they wanted to buy homes. Seller financing morphed from an opportunity to a necessity (which is exactly what’s happening again today).

Back then I was calling on realtors and builders. They all talked about how bad it was. But because I was one of the very few people who knew how to structure a deal with seller financing, I was able to fill the void. And I was killing it!

But wouldn’t you know, times changed (as they always do) and interest rates came back down from the stratosphere to normal levels. When rates dropped, I figured I’d need a new career. But “Morph” is my middle name. I learned from the 80s that builders didn’t want to deal with the slow no at the bank. Instead of dealing with the bank, I helped them see the advantages of being the bank.

Every time there is stress on the market, it causes an impasse. Seller financing is what makes deals happen that won’t happen otherwise. In 1980, it saved the day because the interest rate was so high. In 2018, it saves the day because the purchase price is so high.

For me, the sky has opened up. I find myself talking this topic over and over at every industry networking event and mastermind group. Just a year or two ago they weren’t interested.

YOU WANT TO BE SUCCESSFUL IN NOTES? HANG AROUND SUCCESSFUL NOTE PEOPLE!

It’s good to read books and blog posts (especially mine!) about seller financing. But if you want to get really good at something, you need to be around successful people so their success can rub off on you. My son wants to get good at steer wrestling, so he hangs around with the best steer wrestling coach in the rodeo business. My daughter, who is now a professional ballet dancer, got to be a first class ballerina by getting trained by first class instructors.

Whatever you want to excel at, become part of that environment and learn from people who are already successful at it. As I say, learn to practice perfect. Observe how they do it, then do what they do! I encourage investors to get involved with NoteSchool because it’s the perfect environment to be around successful note people so you can see how it’s done and build long-term wealth.

For your career to thrive, you need a thriving ecosystem. You’ll be around the most experienced note instructors in the industry. We’re up to our eyebrows in this stuff every single day, we know which way the trends are going, and we teach it to you. I feel safe in saying that many of our students are far more knowledgeable than some of the self-proclaimed real estate gurus you’ve seen on TV.

We’re about to launch our newest class where you can get a deep dive into creative seller financing. The class will be called: “Nothing Down Deal Architect – Buying Properties Using Creative Terms.”

I can’t wait to teach it, and I hope you can’t wait to take it. So be watching for the first dates and locations.

Capital Markets Update

Currency Markets, BitCoins and Perspective

By: Ryan Parson

If I asked you to tell me about the New York Stock Exchange, I bet you could come up with a pretty good definition. And I bet you could give me a pretty good overview of other stock exchanges, including NASDAQ, the London Stock Exchange, Hong Kong Stock Exchange and maybe even Euronext. But could you tell me anything about the currency markets? Could you even tell me the name? Here are some things to think about:

Definition

Currencies are traded on the foreign exchange market – Forex, FX or just the currency market – a global, decentralized market for buying, selling and exchanging. Forex is comprised of institutional investors, governments from around the world, large corporations, banks, as well as currency speculators.

Forex differs from the stock markets that you’re familiar with in that those markets are housed in central physical exchanges, whereas Forex is an over-the-counter, decentralized market completely housed electronically.

In terms of trading volume, Forex is by far the largest market in the world. In fact, according to the Bank for International Settlements, foreign-exchange trading averages $5.3 trillion a day – which is about $220 billion per hour. Comparing it to the volume of the NYSE – 30 days of trading on the NYSE equals one day of trading on Forex. As you might suspect, the US dollar makes up most of all Forex trading volume, followed by the Euro and then the Japanese Yen.

And Along Came Bitcoin…

First invented in 2009, Bitcoin is different from other currencies traded on Forex in that Bitcoin does not require and is not backed by a central authority. Instead, Bitcoin is a peer-to-peer system for online payments that runs on a decentralized network of computers around the globe that keep track of all Bitcoin transactions, similar to the decentralized network of servers that makes the internet work.

You can buy Bitcoins with dollars or euros, just like you can trade any other currency. You then store your Bitcoins in an online “wallet.” And then with that wallet, you can spend Bitcoins online as well as in the real world for stuff. But there are no intermediaries – it doesn’t go through your bank or someone else’s bank.

The Currency of the Future?

That’s hard to say of course, but the reality is that if you have a bank account or credit cards or even use PayPal you are already using digital currency. Same thing goes for when you trade stocks – you’re using digital currency. Let’s say you and I placed a trade to buy 100 shares of Apple stock. I’m not expecting you to show up to my office with a bag of money that I can then go deliver in exchange for your Apple shares, right?

The reality is that unless you actually use real cash – and how many of us use cash today – every time you swipe your credit card or debit card, you have to go through an intermediary like your bank or Credit Card Company. And they of course have fees for this service.

Bitcoin, on the other hand, sets up a system where the buyer and seller deal with each other directly.

According to Coinbase, a company that helps users exchange and buy bitcoins, one bitcoin is currently worth about $1,725, which makes it more valuable than an ounce of gold, which trades at about $1,200. But the “value” of a Bitcoin can vary and has varied widely.

Or A Currency for the Shady?

Lately Bitcoin has been in the news after some recent ransomware attacks. The malicious software locks down computers and files and won’t lift the lock-down unless they are paid a ransom in Bitcoins. Why Bitcoins?

Well, because with Bitcoins, the transactions you make are completely anonymous. Instead, whenever you trade a Bitcoin, you use a “private key” associated with your “wallet” to generate computer code that is then publicly associated with your transaction – but with no personal data. For criminals, this makes Bitcoin very attractive.

Perspective for Investors?

Bitcoin could prove to be the model for digital currency going forward. But there are still a lot of things to be ironed out.

In The Spotlight

Recap of the 2nd Annual Seller Finance Coalition Fly-In

The Seller Finance Coalition’s second annual Fly-In last month was a huge success! There were over 30 attendees from all across the country on Capitol Hill for a day and a half informing various congressional offices on the impact seller financing can have on a consumer’s ability to become homeowners as well as its effect on stabilizing communities.

Congressman Roger Williams (TX-25) with support from the Seller Finance Coalition (SFC), and it’s over 40,000 members, put forth H.R. 1360 The Seller Finance Enhancement Act in early 2017. This important bill has bipartisan support and currently has 23 cosponsors from various states.

During the 2nd Annual SFC Fly-In, the Coalition leadership had 10 Congressional Representatives and Industry Leaders speak on Day 1, with remarks on how seller financing is aiding small business owners and neighborhoods across the country. On Day 2, the group hit more than 20 Congressional offices asking for support of H.R. 1360.

The Seller Finance Enhancement Act (H.R. 1360) is making its way through the House Financial Services Committee .We need each of you to email your Congressman and ask him or her to support HR 1360 The Seller Finance Enhancement Act. Today!

Quote of the Month

“Not all readers are leaders, but all leaders are readers.” – President Harry S. Truman

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?