Thoughts from the Desk of Bob Repass…

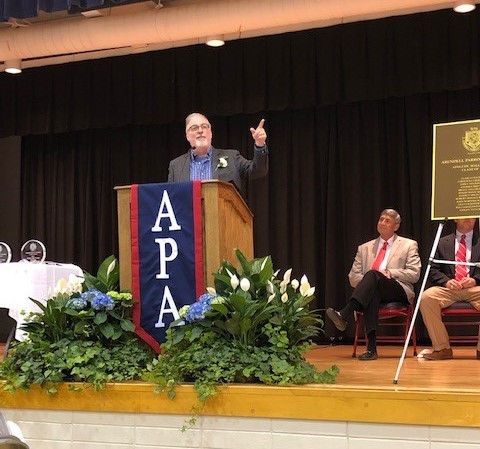

Last week I had the distinct honor of being inducted into my High School Athletic Hall of Fame. This brought on a wave of emotions and memories. I graduated high school in 1979. Yes, 40 years ago!

Thinking back on it, I believe my first experience as a leader of a team came during my sophomore year in high school. I was not quite 15 years old and was the starting quarterback on my high school football team. Here I was leading the team, made up of mostly seniors, three or four years older than me. Not only was I the youngest player on the varsity team, but I also was not very big. Now I was tall, almost 6 foot, but I was skinny with a capital “S”! Maybe 140 pounds soaking wet.

Two things helped put me in the position of being the quarterback at such a young age. First, I love football and the strategy of the game. I watched both pro and college football all the time and would try and guess what the next play would be. Keep in mind this was way before Madden NFL video games hit the scene. I consider myself a “student” of the game.

Second and equally as important, I loved to practice. Putting in the hard work necessary was fun to me. I enjoyed just being on the field around all my teammates. Now don’t be fooled, there were times in the heat and humidity of the summer days of August in Eastern North Carolina when we were running wind sprints or doing other conditioning drills known as “up-downs” that I was wishing that part was over, but inside I knew if I showed the others the intensity needed to get through it we would be a better team because of it.

I will always remember the smell of the fresh cut grass and standing in the huddle in my helmet, shoulder pads and cleats making the play calls. I had earned the respect of my teammates because I had shown how passionate I was about them and the game. I had confidence in myself, as well. Notice I said confidence not to be confused with cockiness. I mean, who can be cocky when you’re the youngest and skinniest one out there!

One of the highlights of my high school days was walking down the halls on Fridays wearing our game–day jerseys and feeling that certain pride that only the ones wearing the jerseys were a part of our team. We knew we were in it together and we had each other’s backs. Game Day was the easy part. All our intensity and hard work at practice was about to pay off at kickoff under the Friday night lights.

As the quarterback I was the leader of the team but of course we had coaches. I was lucky as I was in a position where I had the coach’s ear. I could make suggestions about what plays to call at what time as we built the game plan each week. I could also “suggest” who should get the ball more or which side of the field we should run our plays toward. Working alongside my coaches, I realized the hardest part of leading a team is putting the right people in the right places.

“Football teaches you hard work. It takes a lot of unspectacular preparation to have spectacular results in both business and football.” – Roger Staubach

I may not have envisioned it at the time but these life lessons learned on the field translate to the business world. As an entrepreneur, you have to be ready to take this to another level. The biggest challenge an entrepreneur faces is getting the right people in the right places working together.

“As an entrepreneur, it’s important to remember the mark of a great leader is the ability to delegate. Just like a quarterback on a football field, there’s a lot riding on your ability to call plays and lead the team toward the goal line, but you aren’t going to get very far without blockers to clear the path and someone to throw the ball to down field.” – Brian Spero

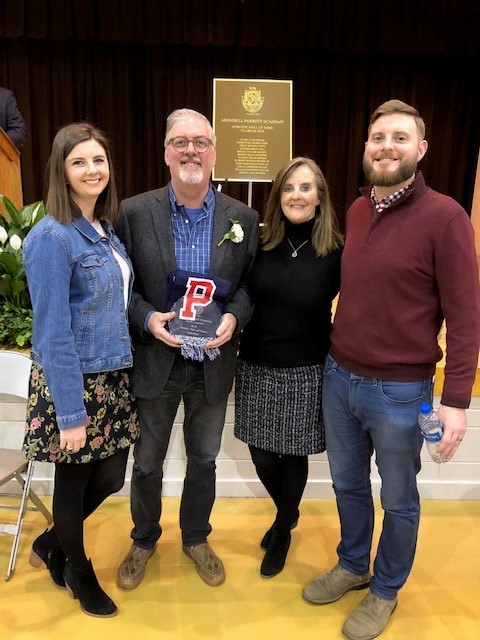

All this came full circle at my Hall of Fame induction ceremony. I was surprised and honored that ten of my teammates and classmates along with two of my coaches were there to support me. Some of them I had not seen in literally 40 years! I was also blessed that my Dad, my sister and her family along with my wife, Angie, son Robbie and daughter Kristin were all there for me as well. Playing high school football was a great experience and taught me a lot, some of which I didn’t realize I had learned until I was much older and wiser.

Bob Repass

Managing Director

Stay up to Speed with Eddie

MAKE MONEY NOW, OR BUILD WEALTH LATER? DO BOTH… WITH NOTES!

by Eddie Speed

It’s the same at a zillion different companies. People trade time for money. You find a company to work for, and trade some of your time for some of their money.

That’s why if you ask most folks their favorite day of the week they say Friday. That’s payday!

Well, here’s a question I want you to think about, and it’s a question that could literally change your future: Instead of trading time for money, what it you could trade money for wealth?

If I said I’d give you $1 today OR double it to $2 spread out over the next five years, most people would grab the dollar. But if I added some zeroes and said I’d give you $100,000 today or $200,000 spread out over the next five years, you’d probably choose the $200,000.

That’s because $2 sounds like money, but $200K sounds like wealth. If you’re simply willing to delay your payday, you can get a lot more later than you get right now.

You make money, but you build wealth.

Of course, I know we all need money right now to keep the lights on, make the house payment, get your transmission fixed, pay for your kid’s braces, and so on. But you’re also going to need money during your golden years – unless you want to be punching a clock while you’re living in the rest home.

One of the most important things I do is encourage people to think less about making money for Friday, and more about building wealth for the years ahead. And after looking at all the other investment options, I’m more convinced than ever that the best way to build wealth is by investing in notes.

Consider the risks, rewards, and flexibility of other investment options:

- If you buy gold coins, their value might go up or down, but they don’t provide 1¢ of monthly income.

- You could buy stocks and sit on them for years hoping they go up in value; but the market might crash. A stock might pay a dividend one year, but the next year zip.

- Annuities can give you modest monthly income, but they can’t bring you a big chunk of income right off the bat.

- If you buy a rent house, you can only structure your investment one way; you get monthly income (if it stays rented), but you pay taxes and insurance, plus there’s no big chunk of income at the beginning.

- You can flip a house for a chunk of income, but you only get one single paycheck after months of work when you sell the house.

None of these other options come close to offering the flexibility of notes. With every note deal you put together, the power is in your hands to structure a deal to get money now or build wealth for later. You can also get a paycheck now, PLUS more paychecks for years to come. You can structure each deal to decide how much you get now versus how much you get later. I can teach you how to structure a transaction six or eight ways, depending on what you want to accomplish.

If you’re a Friday paycheck guy and you get laid off, you could be up the creek for months or more. That means you’ll have to dip into savings and live off your “seed corn.” But if you have steady income from note deals, you can ride it out while you’re on the sidelines. If worse comes to worse, you could sell a few years of future payments on a note for quick income now.

I taught a 3-day NoteSchool class this past weekend. Starting around the middle of the second day, students both old and young started realizing that your payoff doesn’t have to be all up front, or all in the future. They began to see how they could select what they wanted to get out of each trade. You sure can’t do that flipping houses!

I remember the first day I entered the note business 39 years ago. On day one my father-in-law said: “Son, be a wealth thinker.” He was right. You’ll never build wealth if you don’t think wealth.

I’m encouraging people to rise above the typical mindset of trading time for money, and start thinking like an entrepreneur. Instead of working for your money, notes put your money to work for you.

When your money works for you, you build wealth!

Solomon noticed that even an ant prepares for the future by storing up food for the winter. That means an ant, whose brain is smaller than the period at the end of this sentence, is smarter than most people.

The day you stop working is the day your paychecks stop coming. That’s a scary thought.

Will you be ready?

Capital Markets Update

What are your Financial Priorities in 2019

By: Ryan Parson

A lot of people make money resolutions. According to a study in the University of Scranton’s Journal of Clinical Psychology, the most popular resolution every year is to lose weight, followed by getting organized, and saving more money. It’s good to see a finance-related resolution in the top three. But we all know that setting goals is one thing, sticking to them is another.

This year, why not resolve to make your finances a priority? With just a few hours of planning, you can start to get your financial house better organized.

Get Organized

Retrieve all of your important documents that tell you how 2018 went-and read them. Find all of your pertinent financial statements, including retirement and investment account statements, homeowner’s insurance, wills, and bank statements so you can access them quickly. Then:

- Review your 2018 goals

- Read your financial statements

- Are the valuations of your assets correct?

- Did the anticipated cash flows occur within the accounts you expected them to be?

- Understand why you either missed, met, or exceeded your goals

Plan large, out of the ordinary, cash outflows

The centerpiece of a financial resolution is to create a budget for the entire year. This isn’t as daunting as it sounds. Decide with your spouse or other relevant stakeholders what the big expenses will be for 2019. Will you need to buy a new car? Take a vacation? Fix the roof or replace the air conditioner?

By planning ahead and setting aside money in advance, these expenses won’t hit your wallet as hard as they would if there were no plan. A family budget is a great learning opportunity for kids, as well.

This isn’t just about expenses either. You will want to consider how you PAY YOURSELF FIRST, which means allocating capital towards saving and investing objectives, or even paying down debt faster. Depending on your holistic wealth goals, “budgeting” and outflows doesn’t have to mean sacrificing something today necessarily, especially when you can accurately pinpoint what the savings is doing for you later.

Look Forward

Don’t allow mistakes you made in the last 12 months to affect your goals for the coming year. Allow yourself to mentally wipe the slate clean. Use previous stumbling blocks as your new goals for 2019.

Perhaps you had trouble with credit card debt, didn’t save as much as you needed for college, or put off replacing the roof on your house. Address those challenges in your New Year’s plan. Create a timeline for paying off debt, arrange an automatic monthly transfer into your 529 account, or create a list of home repairs you need to address.

Deferred maintenance, especially on our primary homes, sneaks up on many of us regularly. We get so used to thinking that “it’s OK that light is broken, we don’t really use it that much anyway” that all of a sudden we are trying to sell the house down the road and discover the backlog of issues, which can devalue one of the most important assets on our balance sheet. Or worse yet, little problems become very large, costly repairs.

Write It Down

Don’t forget to write down what you want to achieve and place it somewhere you will see it each day. Without regular reminders of your goals, you’ll find it much harder to attain them. If you are using more elaborate tracking mechanisms, make sure those have specific dollar amounts assigned to them, how much you are contributing towards the goal and which account will be used to fund that goal. This makes your overall planning much easier and realistic.

To help, we’ve outlined a financial checklist to make the most of your wealth in 2019.

- Create A Cash Flow Pro-Forma: Track where your money goes, align your contributions to appropriate growth strategies and allocate for large expenses like replacement vehicles and home repairs.

- Take Control of Debt: Paying off debt, however low the interest rate is, frees up cash flow.

- Review Tax-Qualified and Deferred Comp Contributions: These continue to be advantageous vehicles, especially when self-directed.

- Catch-up contributions: If you are age 50 or older, contribute above the regular limit.

- Rebalance your investment selection: Have your risk tolerances changed? May be time to look at your overall mix of traditional and alternative investments.

- Checkup on your Emergency and Investment Fluctuation Reserve Accounts: Are you ready for the “What-Ifs” that occur both in our day to day lives as well as with your investment choices?

- Check your credit report: Just because you are not necessarily using the power of your hard earned credit profile doesn’t mean anybody else should either. With identify theft and fraud a very real risk for all of us today, checking your report to make sure there is no unauthorized activity is a part of your overall wealth preservation.

- Review Insurance Coverages: As our wealth grows, so does our ability to potentially self-insure different types of risks. Understanding that fine line can help to not only save premiums, but structure coverages in the most useful way possible.

- Who are you spending time with? Being around other people that share your wealth preservation and aspiration goals is more important than anything. You don’t want others detracting or diminishing your lofty goals so be mindful of who is in your circle.

- Passive or Active or Both? Know your personal and family investment objectives. This is a subtle, yet necessary component to selecting the various types of private investments with regards to your ongoing time commitment and return expectations.

- Meet with Your Deal Operators: With private/alternative investments, this is one of the greatest features yet least engaged. You have direct contact with those you’ve entrusted your money to. Reviewing the deal every year is a wise strategy to understanding how the deal is expected to continue to perform.

In The Spotlight

Message from the Seller Finance Coalition

The Seller Finance Coalition continued to make significant progress towards regulatory relief for our industry in 2018.

The Seller Finance Enhancement Act (HR 1360) was introduced in the Financial Services Committee by Congressman Roger Williams and 23 bipartisan cosponsors. Unfortunately the clock ran out on us before the bill went to mark-up in the committee but we are pleased with the input and direction we received from all our cosponsors.

2019 is shaping up to be a very interesting year to say the least, especially from a legislative perspective, and your continued support is going to be key to helping push our efforts. We have a two-pronged approach heading into this new session of Congress.

- First, we are looking to reintroduce The Seller Finance Enhancement Act in the House Financial Services Committee with a Democratic lead sponsor to join our Republican lead sponsor Roger Williams.

- Secondly, we are working to introduce a companion bill on the Senate side through the Banking Committee. We are working for bipartisan lead sponsors for that bill as well.

These two efforts will take all of us working together on a grassroots level both at home and in D.C. We will be hosting our Annual National Fly-in on April 30th and May 1st to hear from various legislators and hit the Hill telling our stories. I encourage all of our members and others you can invite to join us in D.C.

Thank you for your continued faith in our leadership as we look to solve the problems facing our industry.

RSVP For Our Third Annual Washington Lobby Day by Clicking Here!

Sincerely,

SFC Leadership Team

Quote of the Month

“If you don’t believe in yourself, why is anyone else going to believe in you?” – Tom Brady

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?